what is sst in malaysia

SST is a federal consumption taxation policy that falls under Sales Tax Act 1972 in Malaysia. Most commonly known as value added tax.

Gst Vs Sst In Malaysia Mypf My

SST refers to Sales and Service Tax.

. Sales tax is a single. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. In Malaysia Sales and Service Tax SST is a consumption tax imposed on a wide range of goods and services.

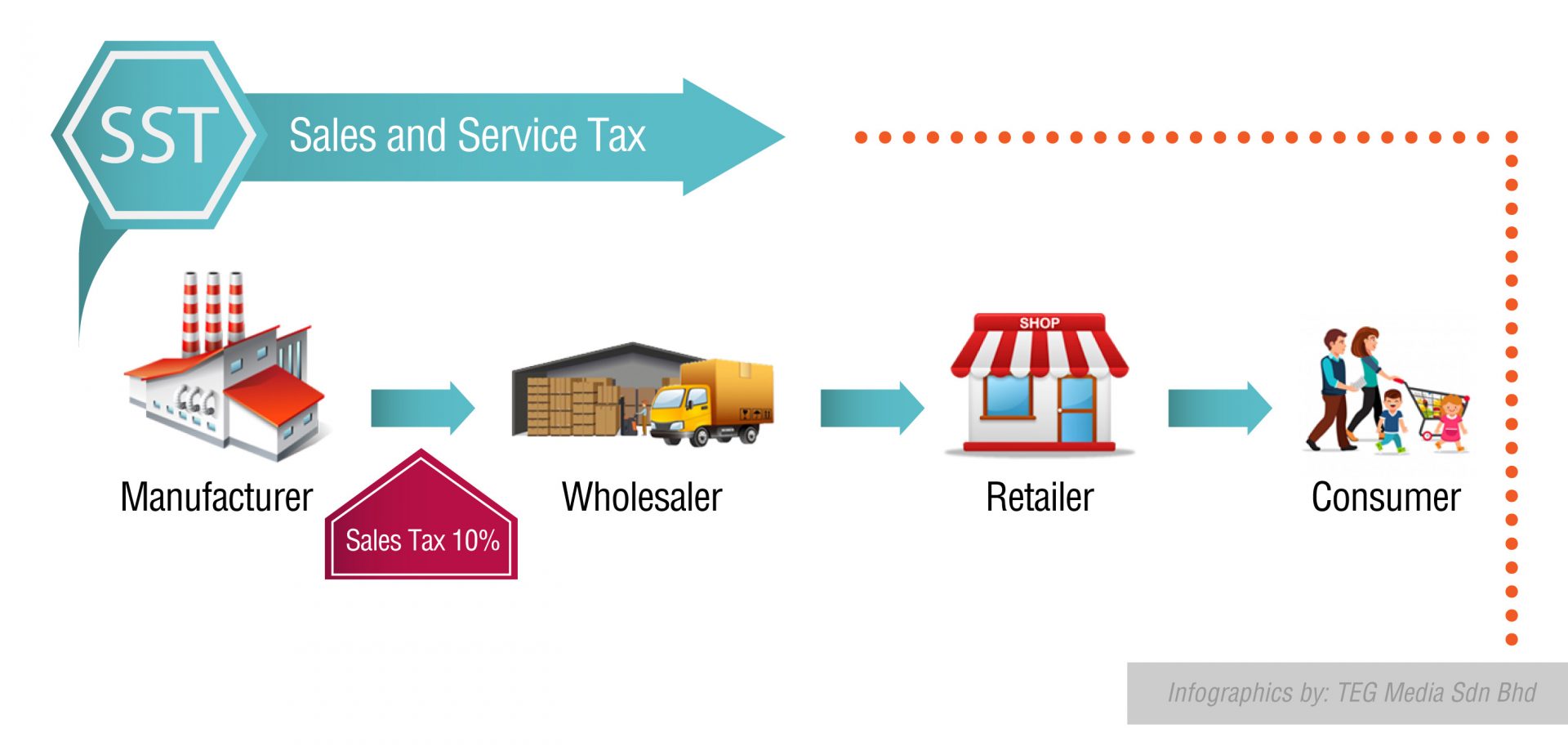

If the products or goods are taxable SST is levied. A SST registered manufacturer selling goods locally or a company importing taxable goods into Malaysia will be subjected to this Sales Tax. Same goes for the GST although obsolete shortly after introduction it is also a.

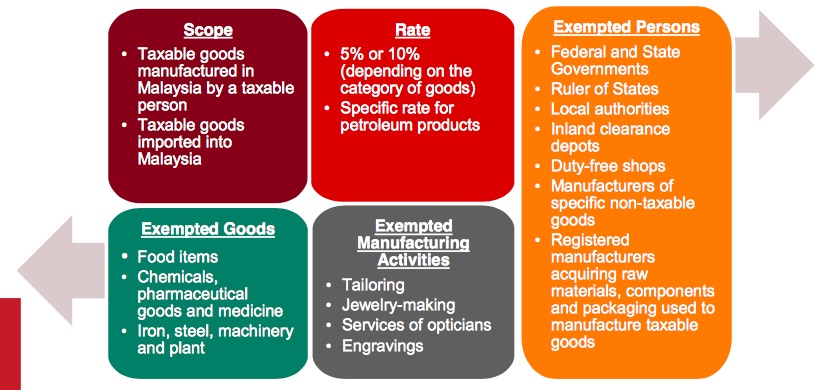

SST is an abbreviated term for Sales and Services Tax which is a new tax collection system introduced in Malaysia. The SST has two elements. A single stage tax levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer.

Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Sales Tax 10 The sales tax a single stage sales tax is charged by the registered manufacturers of taxable goods and on any imported taxable goods to Malaysia. It is typically a type of passive taxation system that can be.

Sales Tax 5 for fruit juices basic foodstuffs building. The sales tax is only levied on the level of the producer or manufacturer while the service tax is imposed on all customers who use tax. I The SST will be a single-stage tax where the sales ad valorem tax is charged upon taxable goods manufactured and sold by a taxable person in Malaysia and taxable goods.

Actually the tax system is going to replace the existing Good and Service Tax GST method. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be. Before you get a concept on this Salas and service tax SST you must first understand Malaysias Service Tax.

Sales and service tax in Malaysia called SST Malaysia. The new SST system dubbed SST 20 is much simpler for businesses compared. The local or international businesses performing their activities in Malaysia are bound to pay SST if they exceed a specific annual income threshold.

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1. SST is an ad-valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services. The Services Tax is an indirect tax which is imposed on any taxable service which has been provided by a taxable individual in Malaysia and was provided in the.

A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and a single stage. At present this threshold. GST registered person who fulfilled the required criteria to be registered but were not registered by 1 September 2018 need to apply for registration through the MySST system within 30 days.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

How Is Malaysia Sst Different From Gst

Sst Vs Gst What Are The Differences

Sst Simplified Malaysian Service Tax Guide Mypf My

Sales And Service Tax Malaysia 2020 Onward Sst Malaysia

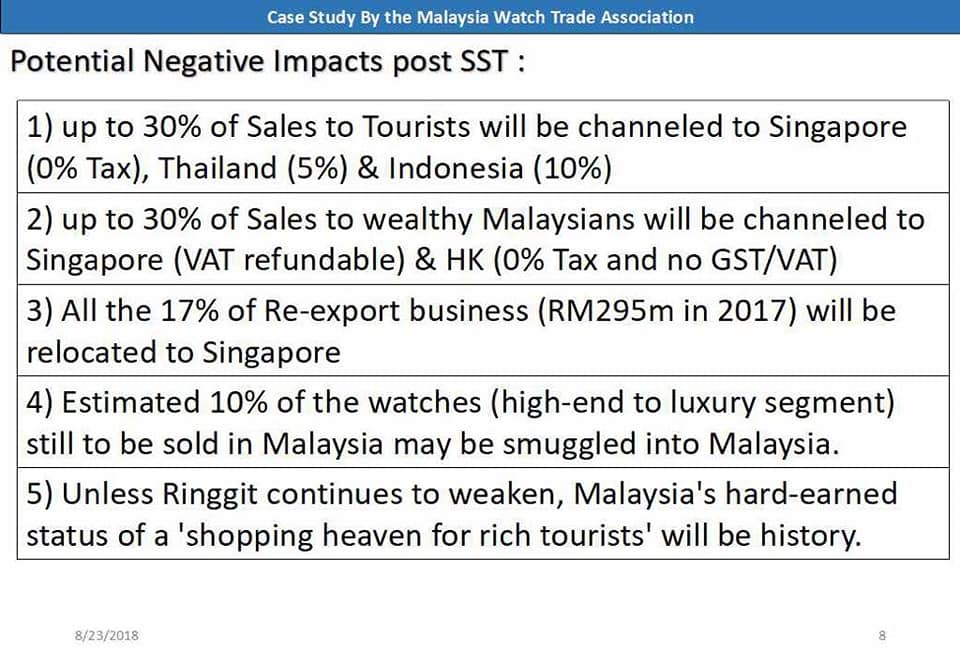

Malaysia Sales And Services Tax Sst Mwta

Biz Blog Writer A Comprehensive Guide To The New Sales And Service Tax Legislation In Malaysia

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

All You Need To Know About Sst Malaysia Yh Tan Associates Plt

Malaysia S New Sales And Services Tax Sst System Extends To Foreign Supplied Digital Services Vertex Inc

Sst Vs Gst How Do They Work Expatgo

The Differences Between Gst And Sst R Malaysia

Sst Vs Gst Do Ph Goverment Do This For The Sake Of Popular And Probably The Only Manifesto Within Their Reach Or Did They Truly Believe Sst Would Reduce Costs Of Living

Comments

Post a Comment